Fuel Price Calculations

Our mission is to educate Washington residents on the economics, policies, and supply-chain factors that determine fuel prices. We are committed to empowering Washington drivers with clear, unbiased information to help consumers understand the true forces behind what they pay at the pump.

Current Fuel Prices

Understanding the price on the pump starts with knowing what goes into each gallon. In Washington, fuel costs are shaped by a mix of market forces, taxes, and state-specific programs. Here's the breakdown:

Carbon Program Costs (WA Specific)

Washington's fuel prices are influenced by state-specific carbon programs that add costs before fuel ever reaches the pump. These costs are not fixed taxes — they are market-based and variable, which is why prices can change quickly.

These costs are passed through the supply chain and are a major reason fuel prices in Washington state are higher — and more volatile — than in neighboring states.

How it works - fuel suppliers must buy carbon allowances and credits under WA's Cap-and-Invest and Low Carbon Fuel Standard (LCFS) programs

- These carbon costs fluctuate, so fuel prices can change even when oil prices don't

- The cost is added at the fuel terminal (the rack) and passed through the supply chain

Here's a deeper dive into the state-specific carbon programs.

1. Washington uses a Cap-and-Invest system.

Under Washington's climate policies, fuel suppliers are subject to a cap on carbon emissions.

- The state limits how much carbon pollution fuel suppliers can generate.

- To sell fuel, suppliers must hold carbon allowances that cover those emissions.

- The total number of allowances is limited, which creates scarcity.

2. Fuel suppliers must buy carbon allowances

Fuel refiners and importers:

- Purchase allowances at state-run auctions or on the secondary market

- Compete with other regulated industries for a limited supply

- Face real market prices, not preset fees

These allowance prices can move up or down based on:

- Demand for fuel

- Auction results

- Regulatory changes

- Economic conditions

3. LCFS adds an additional compliance cost

In addition to Cap-and-Invest, Washington's Low Carbon Fuel Standard (LCFS):

- Requires fuel suppliers to reduce the carbon intensity of fuels

- Forces suppliers to buy credits if they can't meet targets

- Adds another layer of cost tied to carbon markets

Together, these programs create stacked compliance costs.

4. These costs are added at the fuel terminal ("the rack")

Carbon program costs are applied at the wholesale level and are built into the rack price fuel stations pay. Gas stations do not control these costs.

Once added at the rack:

- The cost flows through trucking and retail

- Then finally shows up in the price consumers pay

- There is no separate "carbon fee" on your receipt — it's embedded in the price per gallon.

5. Costs fluctuate — so prices fluctuate

Because allowance and credit prices are market-based:

- Costs can change weekly or even daily

- Fuel prices can rise even when crude oil prices stay flat

- Volatility is higher than in states without these programs

This is why Washington prices can move faster and farther than nearby states.

6. Why this makes Washington different from neighboring states like Idaho and Oregon?

These states:

- Do not have the same combination of carbon programs

- Face lower or no allowance costs

- Have fewer regulatory cost layers built into fuel prices

As a result:

Washington fuel prices structurally sit above regional and national averages, even under similar market conditions.

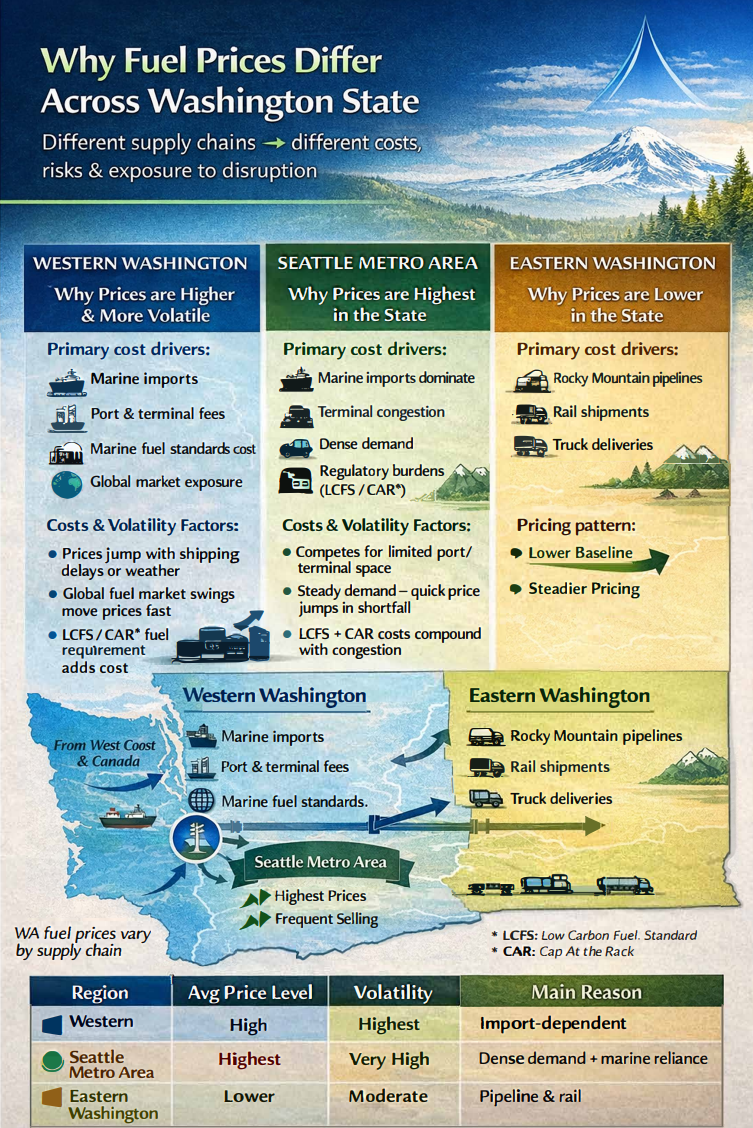

Why Fuel Prices Differ

Additional Price Factors

Crude Oil Costs

Crude Oil Costs

- •The largest part of any gallon of gas.

- •Determined by global supply and demand

- •Influenced by geopolitics, production cuts, and world market shifts

- •When crude prices rise, Washington prices usually rise soon after.

Refining & Production

Refining & Production

- •This includes converting crude oil into gasoline or diesel.

- •Refinery maintenance or outages impact supply

- •WA relies heavily on West Coast refineries

- •Cleaner fuel standards can increase costs

Transportation & Distribution

Transportation & Distribution

- •Getting fuel from refinery → terminal → your local gas station.

- •Trucking costs

- •Pipeline/terminal fees

- •Regional distance from refineries

Retailer Margin

Retailer Margin

- •A small portion goes to the gas station itself.

- •Covers operating costs (credit fees, rent, utilities, wages)

- •Margins vary but are usually a small percentage of the total price

- •Gas stations make more on snacks and soda than on fuel.

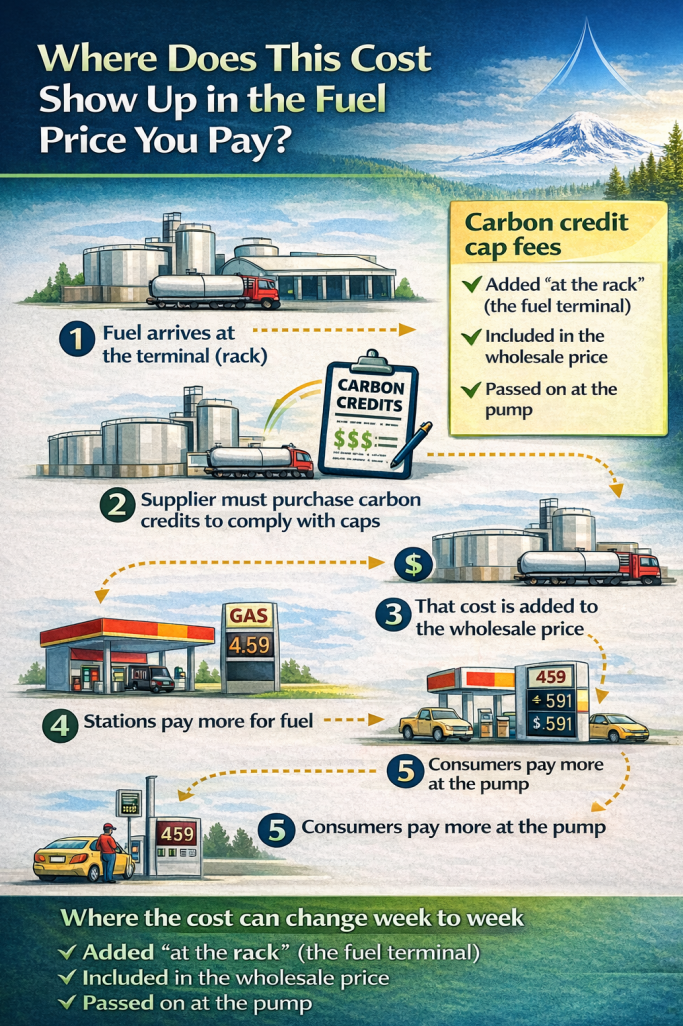

What is the "carbon credit cap at the rack" — and why does it matter to you?

The "rack" is the wholesale fuel terminal where gas and diesel are sold to distributors before it goes to your local station.

Under Washington's climate programs — LCFS (Low Carbon Fuel Standard) and CAR (Clean Air Rule / cap-and-invest) — fuel suppliers must buy carbon credits to cover the emissions associated with the fuel they sell.

What does a "cap" mean?

The state places a limit (cap) on the total carbon emissions allowed. If fuel suppliers exceed their allowance, they must buy carbon credits at auction or on the open market.

Those carbon credits:

- Have real, fluctuating prices

- Are added at the rack, not at the pump

- Become part of the base cost of fuel

How this shows up in your fuel price

Even though you don't see a separate "carbon fee" on your receipt, the cost is embedded in the price per gallon.

Step by step:

- Fuel arrives at the terminal (rack)

- Supplier must purchase carbon credits to comply with the cap

- That cost is added to the wholesale price

- Stations pay more for fuel

- Consumers pay more at the pump

Why the cost can change week to week

Carbon credit prices are not fixed. They move based on:

- Supply of credits

- Demand from fuel suppliers

- Auction results

- Regulatory changes

When credit prices rise, fuel prices rise, even if crude oil prices stay flat.

Why this impacts some regions more than others

Regions that:

- Rely heavily on imports

- Have limited terminal capacity

- Experience high demand

…have less flexibility to absorb these costs.

That's why Seattle and Western Washington often feel the impact faster and more sharply than Eastern Washington.

The key takeaway for consumers

Carbon credit costs are real, variable, and built into the price of fuel before it ever reaches your gas station.

They are not optional, and they help explain:

- Why prices can rise without obvious market disruptions.

- Why Washington fuel prices differ from neighboring states.

- Why price swings can happen quickly.

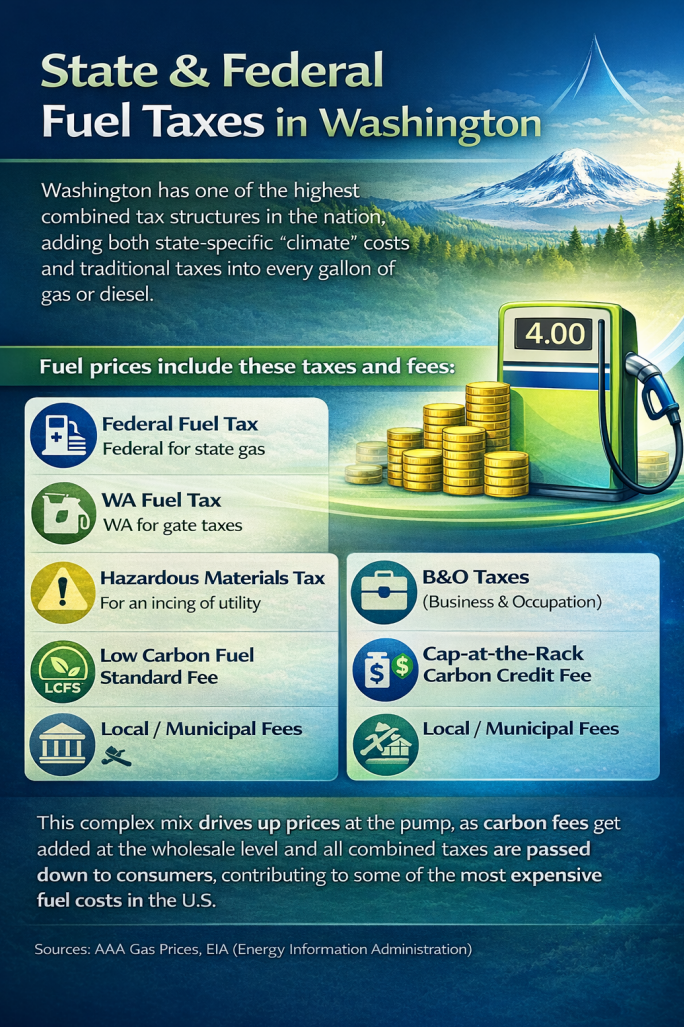

Fuel prices in Washington reflect one of the highest combined tax and fee structures in the nation. Every gallon of gas or diesel includes the federal fuel tax, Washington state fuel tax, and additional charges such as the Hazardous Materials Tax and Business & Occupation (B&O) taxes.

On top of traditional taxes, Washington fuel prices also include the costs outlined above, including the LCFS fee and Cap-at-the-Rack carbon credit fees. In some areas, local or municipal fees may also apply, further increasing the price drivers pay at the pump.

The Bottom Line

Fuel prices in Washington are shaped by global markets, local supply chain realities, state policies, and retail competition. Understanding each layer helps you see why prices change — and why they differ across the state.